An Interest-ing Turn of Events

In an interest-ing turn of events, the Fed showed some cautious optimism in its statement and subsequent press conference on December 13th.

It appears that the Fed’s most recent monetary policy cycle, which saw 11 interest rate hikes in 2022 and 2023, is serving its intended purpose. The Fed also scaled back its debt security purchases over that period of time. These strategies (increasing the discount rate and quantitative tightening) are some of the tools that the Fed can use to restrict the country’s money supply and slow down inflation. At least, that’s what it says in my economics textbook!

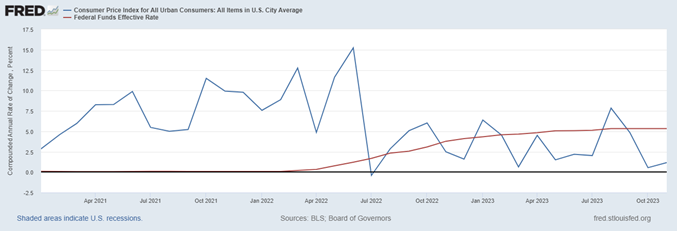

Check out the monthly data for CPI (compounded annual rate of change) versus the effective federal funds rate (as a percentage) from January 2021 to November 2023. CPI is in blue and the effective federal funds rate is in red. This data seems to jive with the Fed’s December statement, which says “inflation has eased over the past year but remains elevated.” 1

Let’s cut to the chase. Does any of this mean that interest rates will come down soon???

The answer to that question remains a mystery. During Fed Chair Jerome Powell’s press conference in December, he stated “we believe that our policy rate is likely at or near its peak for this tightening cycle,” but “they do not want to take the possibility [of further raising interest rates] off the table.”

However, many are finding hope in the Fed’s Summary of Economic Projections, where members gave their opinion on an appropriate and likely plan for moving forward with interest rates. “If the economy evolves as projected, the median participant projects that the appropriate level of the federal funds rate will be 4.6% by the end of 2024, 3.6% by the end of 2025, and 2.9% by the end of 2026.” 2

So does that mean that we should go out and put all of our investments into real estate???

No. While it is true that real estate prices increase when interest rates fall, this expectation has already been priced in to real estate investments. Remember that markets react quickly to new information. This is what makes it so difficult to time markets. Today is no better day for a real estate investment than yesterday, or the day before, or the day before that. (You get the idea.)

You may have noticed a strong recovery in your existing real estate investments during the 4th quarter of 2023. The MSCI World Real Estate Index grew 17.48% in Q4. These developments in the interest rate environment are likely a contributing factor.

What about bonds? Should we buy them up while interest rates are still high???

Similar answer to the real estate question. It is true that current bond yields are more attractive when interest rates are expected to fall. However, this expectation has already been priced in to bond investments. The Bloomberg Global Aggregate Bond Index grew 8.1% in Q4.

So what are we supposed to do now???

Strap in. Don’t let recent market events or forecasts shake your confidence in the investment allocation that you’ve chosen. That is not to say that periodic reviews of your investment allocation (especially when personal circumstances change) are unhelpful. It should definitely be reviewed from time to time, but our philosophy has never been about trying to jump in/out of the market when we perceive it to be hot or cold.

Citations:

1. FOMC Statement, December 13, 2023.

2. FOMC Press Conference, December 13, 2023.